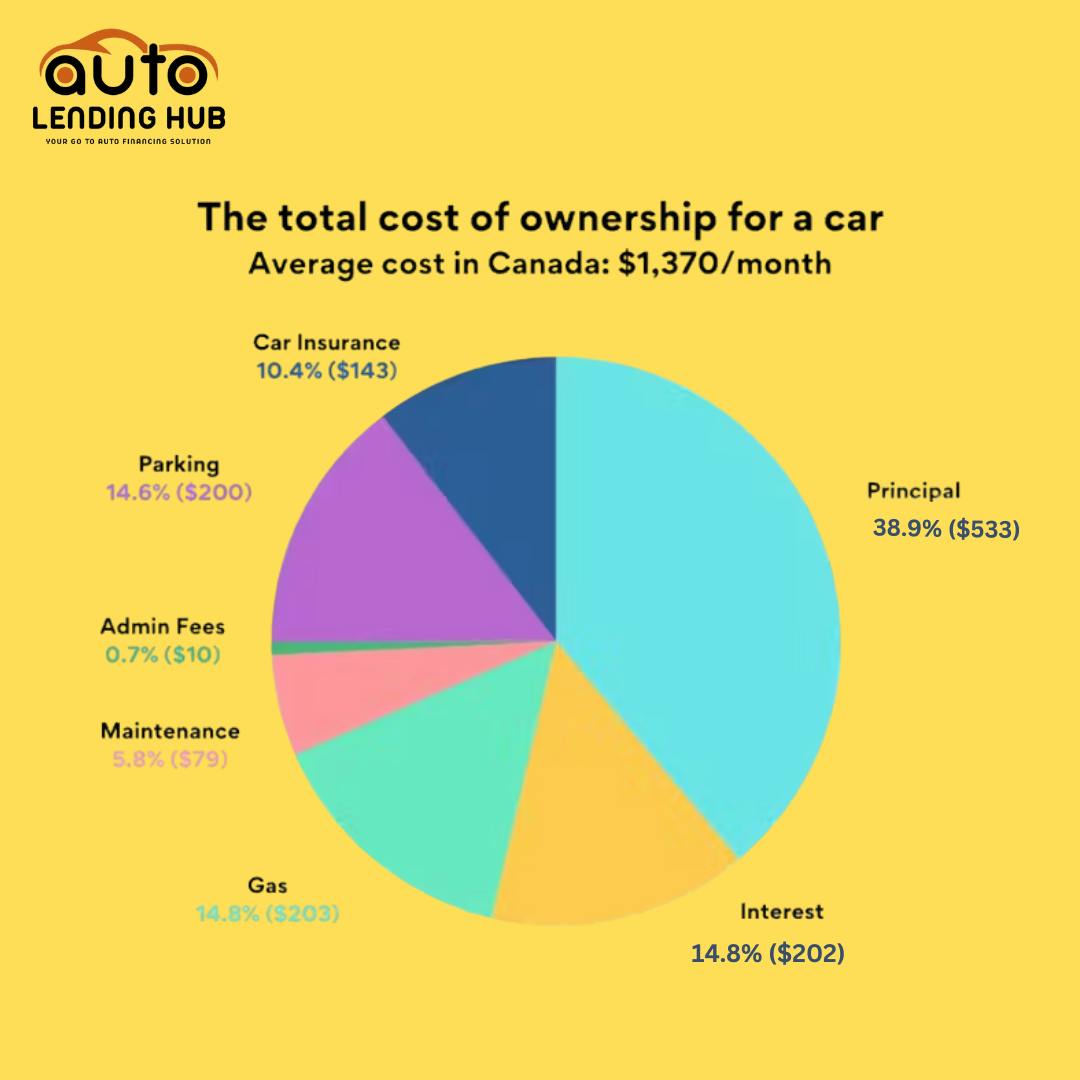

Whether you purchase a new car or a used car, the cost of owning a vehicle can mean a significant increase in monthly expenses. There are many factors that can lead to a high car cost, even with low car loan rates British Columbia.

If you are new to vehicle ownership, then it's a must for you to know the monthly and annual charges before you finalize your car loan British Columbia. From knowing the average Canadian insurance rates to calculating the average amount spent on gas refueling every month, there are many expenses both new and old car owners need to take note of.

After reading this blog, you will be able to calculate the monthly and annual expenses and understand the total cost of owning a car. We will explore the main factors influencing the costs of owning a car in Canada. Before you go to any British Columbia car dealerships, reading these points will help you make a smarter decision when purchasing a vehicle.

![British Columbia Used Car Tax | Used Vehicle Tax In BC [2025]](https://images.prismic.io/autolendinghub/aBA3OvIqRLdaBsPl_midsection-customer-signing-contract-table_1048944-6900322.avif?auto=format%2Ccompress&rect=0%2C52%2C626%2C313&w=3840&fit=max)

![How Much Credit Score is Required For Car Loan in Canada? [2025]](https://images.prismic.io/autolendinghub/Z5peVpbqstJ9-AaC_pexels-photo-7236362.jpeg?auto=format%2Ccompress&rect=0%2C94%2C1125%2C563&w=3840&fit=max)

![How To Avoid Paying Taxes On Used Car Purchases In BC [2025]](https://images.prismic.io/autolendinghub/Z0GBlq8jQArT1Oj8_image3.png?auto=format%2Ccompress&rect=0%2C177%2C1127%2C564&w=3840&fit=max)